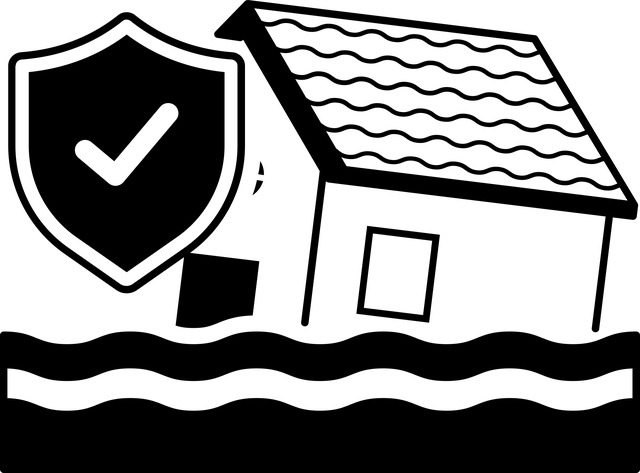

Many homeowners believe their standard policy protects against flooding—a growing concern worldwide. The reality is, typical home insurance policies explicitly exclude flood damage, leaving properties vulnerable to devastating losses. With an increasing frequency of severe weather events, it’s time to consider dedicated flood insurance as a vital line of defense for your home and investment.

This comprehensive guide explores the gap in home insurance coverage, the rising need for flood protection, and provides a step-by-step assessment of your property’s risk. Learn about various policy options, understand the benefits, and discover how to secure peace of mind with suitable house insurance rates tailored to your needs.

- Understanding the Gap: Why Standard Home Insurance Doesn't Cover Floods

- The Rising Need: Addressing Increasing Flood Events with Dedicated Insurance

- Assessing Your Property's Flood Risk: A Step-by-Step Guide

- Unlocking Protection: Exploring Flood Insurance Policy Options and Coverage

- Peace of Mind and Financial Security: Benefits of Having Flood Insurance

- Home Insurance 101: Comparing Quotes, Understanding Rates, and Protecting Your Investment

Understanding the Gap: Why Standard Home Insurance Doesn't Cover Floods

Standard homeowners insurance policies are designed to protect against a wide range of perils, from fire and theft to vandalism and natural disasters like earthquakes or hurricanes. However, one significant exclusion is flood damage. This gap in coverage is crucial to understand, especially given the increasing frequency and severity of flooding events worldwide. Floods can cause substantial destruction, leaving homes and their contents at risk of severe water damage, mold growth, and even structural issues.

While home insurance quotes often seem appealingly affordable, they may not adequately cover the potential financial burden of a flood-related incident. This is where separate flood insurance policies step in as essential additions to homeowners’ protection strategies. By assessing your property’s flood risk and understanding the specific coverage options available, you can ensure that your valuable assets and investments are safeguarded against these unpredictable events.

The Rising Need: Addressing Increasing Flood Events with Dedicated Insurance

In recent years, the frequency and intensity of flooding events have significantly increased across various regions, posing a growing threat to homeowners. This rising trend highlights the urgent need for adequate insurance coverage that specifically addresses flood-related damage. Standard home insurance policies typically do not include protection against floods, leaving many property owners vulnerable to substantial financial losses during these unpredictable events.

The necessity of dedicated flood insurance has never been more evident as communities grapple with the aftermath of devastating flooding. By securing this specialized coverage, homeowners can safeguard their investments and personal belongings. Additionally, it provides peace of mind, ensuring that individuals are financially secure and better equipped to recover from unforeseen flood incidents. When considering home insurance quotes, exploring options for property insurance that includes comprehensive flood protection is a proactive step towards mitigating potential risks and safeguarding one’s assets.

Assessing Your Property's Flood Risk: A Step-by-Step Guide

Assessing your property’s flood risk is a crucial step in determining if a separate flood insurance policy is right for you. Here’s a step-by-step guide to help you navigate this process:

1. Locate Your Property’s Flood Zone: Check with your local government or visit online resources to understand the designated flood zones in your area. These maps show areas prone to flooding based on historical data and terrain features. Understanding where your property falls within these zones is key to gauging your risk.

2. Consider Local Weather Patterns: Research historical rainfall patterns and storm surges in your region. Areas with frequent heavy rainfall or proximity to major rivers are more susceptible to flooding. Knowing the typical weather events that impact your area can help you anticipate potential risks.

3. Evaluate Topography and Land Use: Assess the topography of the land surrounding your property. Sloped areas may increase water flow towards your house, while low-lying regions are more vulnerable during floods. Additionally, consider nearby development; dense urbanization can exacerbate flooding by blocking natural drainage paths.

4. Inspect Your Home’s Foundation and Basement: Examine your home for any signs of previous flood damage or moisture issues. Check the foundation, basement, and crawl spaces for water stains, mold, or structural problems. These indicators may suggest past flooding that could impact future risks.

5. Obtain Home Insurance Quotes: Once you have a clearer understanding of your property’s flood risk, reach out to insurance providers to get personalized home insurance quotes. Be transparent about the potential flood concerns and inquire about specific coverage options for flood damage, personal liability, and protection for your home contents. Comparing home insurance quotes from multiple providers will help you find the best balance between cost and comprehensive protection, including flood insurance if necessary.

Unlocking Protection: Exploring Flood Insurance Policy Options and Coverage

Unlocking Protection: Exploring Flood Insurance Policy Options and Coverage

In the face of escalating flooding events, many homeowners realize that their standard home insurance policies may not provide sufficient protection against such natural disasters. This is where flood insurance steps in as a crucial safety net. When considering flood insurance, it’s essential to understand the various policy options available and the coverage they offer. Home insurance quotes from multiple providers can give you a comprehensive view of what’s on the market, allowing you to compare house insurance rates based on your specific needs.

Flood insurance policies typically cover direct physical damage caused by flooding, including water intrusion, rising waters, and other related incidents. Personal liability coverage is also often included, protecting against claims for damages or injuries to others resulting from a flood-related incident at your property. Additionally, home contents insurance ensures that your belongings are protected, offering peace of mind should your home sustain damage and require repairs or replacements. By assessing your property’s flood risk and exploring these options, you can secure the financial security and safety net needed to navigate flooding events with confidence.

Peace of Mind and Financial Security: Benefits of Having Flood Insurance

Having flood insurance provides both peace of mind and financial security for homeowners. In a world where flooding events are becoming increasingly common and severe, standard home insurance policies often fail to cover these unforeseen disasters. Flood insurance steps in to protect against significant losses, ensuring that policyholders can recover from the financial strain caused by devastating water damage. This specialized coverage offers valuable peace of mind, knowing that your property and belongings are safeguarded.

Additionally, flood insurance includes personal liability coverage, protecting you from claims related to injuries or damages sustained on your property during a flooding incident. It also covers the cost of moving and temporary housing if your home becomes uninhabitable. By securing flood insurance, homeowners can safeguard their investments, protect their assets, and ensure they’re prepared for any potential water-related hazards, all while enjoying the comfort of knowing they have comprehensive protection against these growing risks.

Home Insurance 101: Comparing Quotes, Understanding Rates, and Protecting Your Investment

Understanding home insurance is crucial when protecting your investment and ensuring peace of mind. When comparing quotes for home insurance, it’s important to assess various factors that influence house insurance rates. Start by evaluating the type of coverage needed—property insurance protects your home structure while personal liability coverage shields you from financial loss due to accidents or injuries on your property. Home contents insurance is essential to safeguard your belongings and valuables against theft or damage.

Collecting multiple home insurance quotes allows for a comprehensive comparison. Review policy details, deductibles, and coverage limits. Consider the value of your property, location, and specific risks like natural disasters prevalent in your area. Engaging with reputable insurers enables informed decision-making, ensuring you secure adequate protection at competitive rates to safeguard both your home and valuables.

In light of increasing flood risks and the gap in standard home insurance policies, it’s crucial to consider dedicated flood insurance. By assessing your property’s flood vulnerability and exploring available policy options, you can gain peace of mind and protect your investment with comprehensive financial security against flood-related damages. Remember that proactive measures, like understanding both home insurance quotes and coverage, are key to safeguarding your home and belongings in an ever-changing climate.